For small business owners, freelancers, and independent contractors, payroll management can be time-consuming and costly. Fortunately, with a free payroll check maker, you can generate payroll checks quickly and efficiently without expensive software or accounting services. This guide will walk you through the process of creating payroll checks in minutes.

Why Use a Free Payroll Check Maker?

A free payroll check maker simplifies payroll processing by automating calculations, formatting professional paychecks, and ensuring accurate record-keeping. Here’s why you should consider using one:

- Saves Time: Eliminates manual payroll calculations.

- Cost-Effective: No need to invest in costly payroll software.

- User-Friendly: Designed for small business owners and freelancers.

- Instant Generation: Get printable paychecks in minutes.

- Accessible Anywhere: Use online tools from any device.

Step-by-Step Guide to Generating Payroll Checks for Free

Step 1: Gather Employee or Contractor Information

Before using a free payroll check maker, collect necessary details such as:

- Full name and address

- Employee ID or Social Security Number (SSN)

- Pay rate (hourly or salary)

- Work hours and overtime details

- Tax deductions and benefits (if applicable)

Step 2: Choose a Reliable Free Payroll Check Maker

There are various online payroll check generators available. When selecting one, consider:

- Security Features: Ensures data privacy.

- Ease of Use: User-friendly interface.

- Customization: Allows tax deductions and benefit additions.

- Compliance: Aligns with federal and state payroll regulations.

Step 3: Input Payroll Details

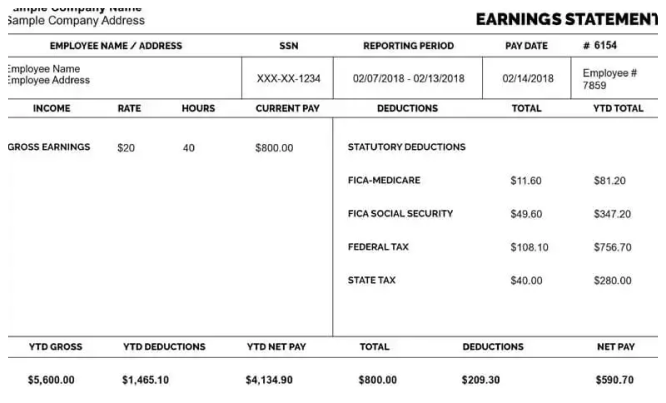

Using the chosen free payroll check maker, enter essential payroll information:

- Employee name and payment period

- Gross earnings (before deductions)

- Taxes and deductions (state, federal, social security, etc.)

- Net earnings (after deductions)

Step 4: Generate and Review the Payroll Check

After entering all details, generate the payroll check. Before printing or saving, review the check for:

- Accuracy: Ensure correct calculations.

- Compliance: Verify tax deductions and compliance with payroll laws.

- Professional Formatting: Ensure a polished and professional look.

Step 5: Print or Download Payroll Check

Once reviewed, you can:

- Print the paycheck for immediate distribution.

- Save as a PDF for digital records.

- Email to employees or contractors as needed.

Advantages of Using a Free Payroll Check Maker

1. Eliminates Payroll Errors

Manual payroll processing can lead to mistakes. A free payroll check maker ensures accurate calculations every time.

2. Improves Payroll Organization

Keeping track of payroll records is essential. These tools help maintain organized, digital records for audits or financial planning.

3. Fast and Convenient

Generating payroll checks within minutes saves business owners valuable time, allowing them to focus on operations and growth.

4. Suitable for Small Businesses and Freelancers

For those who don’t require full-scale payroll software, these tools offer a perfect solution for managing payments efficiently.

Are Free Payroll Check Makers Trustworthy?

While free payroll tools offer convenience, it’s important to choose a trustworthy platform. Look for:

- Secure encryption for data protection

- Accurate tax calculations based on current laws

- Positive user reviews and testimonials

Conclusion

A free payroll check maker is a game-changer for small business owners, freelancers, and independent contractors. With just a few clicks, you can generate payroll checks in minutes, saving time and money while ensuring accuracy. By following these steps, you can streamline your payroll process effortlessly. Choose a reliable tool, input your details, and start creating professional payroll checks today!

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?