Freelancers in the skilled trades—especially electricians and plumbers—are the backbone of everyday life. Whether fixing faulty wiring, installing a water heater, or remodeling an entire home, your work keeps homes and businesses running smoothly. But while you’re busy solving physical problems, managing paperwork like invoices, taxes, and pay documentation can easily become a hassle.

If you’re a freelance electrician or plumber, chances are you’ve been paid in many different ways—by check, cash, Venmo, or direct deposit. While flexible payments are great, the challenge comes when you need proof of income for tax season, a loan, or a rental application. That’s where a free paycheck creator can be a powerful and stress-relieving tool.

This blog explores how freelance electricians and plumbers can benefit from using a paycheck generator free of charge, how it works, and why it’s essential for your business growth and financial security.

Who Is This For?

This article is meant for:

-

Self-employed electricians and plumbers

-

Freelancers in skilled trades without payroll departments

-

Independent contractors doing residential or commercial jobs

-

Side-hustle workers handling occasional repair or installation gigs

-

Journeymen or master electricians/plumbers working solo

If you work for yourself or take jobs outside of a traditional employer, this article is for you.

What Is a Free Paycheck Creator?

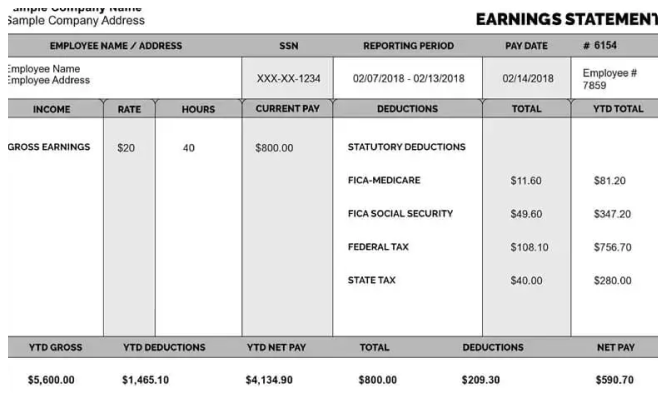

A free paycheck creator is an online tool that lets you generate a paycheck or pay stub quickly and easily—without having to use expensive software or hire a bookkeeper. These tools help you document your income by generating professional pay stubs based on the payment details you input.

You can include:

-

Hours worked

-

Pay rate

-

Deductions (like taxes or materials)

-

Net pay

-

Date of payment

-

Your business name and client info

The result is a clean, professional-looking pay stub that looks just like the ones employees of big companies receive.

Why Freelancers Need a Paycheck Generator

As a freelance electrician or plumber, you probably don’t receive regular pay stubs. But there are several reasons why creating your own pay stubs is a smart move:

1. Prove Your Income

Whether you’re applying for a mortgage, renting an apartment, or buying a vehicle, lenders and landlords want to see proof of consistent income. Bank statements alone often aren’t enough. A free paycheck generator lets you create official-looking stubs that provide reliable documentation of your earnings.

2. Simplify Tax Time

Tax season is a major headache for many freelancers. When you use a free paycheck creator, you can keep a record of every payment you’ve received throughout the year. That means fewer surprises when it’s time to file, and fewer errors when calculating taxes owed.

3. Look More Professional

Clients and contractors trust professionals who handle business properly. Providing a clean pay stub along with your invoice gives your work an extra layer of credibility. It shows you run a legitimate operation and take your business seriously.

4. Organize Your Finances

Pay stubs help you track how much you’re making and how much you’re spending. This is especially helpful if you’re juggling multiple clients or projects. You can see exactly how much you earned each week or month, which makes budgeting easier.

How a Free Paycheck Creator Works

Using a free paycheck creator is simple. Here’s a step-by-step breakdown of how it works:

Step 1: Choose a Paycheck Generator

Search online for a free paycheck creator (like eFormscreator or similar). Make sure the tool is secure, easy to use, and doesn’t add watermarks or force you into a subscription.

Step 2: Enter Your Payment Info

You’ll need to enter:

-

Your name or business name

-

Your client’s name or the company paying you

-

Date of payment

-

Hours worked or flat rate

-

Hourly wage or total amount earned

-

Any deductions (for tools, materials, or taxes)

Step 3: Generate the Pay Stub

After entering the details, the system will calculate your gross pay, deductions, and net pay. It then creates a downloadable and printable pay stub.

Step 4: Save and Store

You can keep these stubs for your records, print them out for clients or landlords, or upload them when applying for loans.

Example: A Day in the Life

Let’s take an example. Jake is a freelance electrician in Texas. He just finished a three-day project wiring a new office building. The company paid him $1,500. Instead of just depositing the check and moving on, Jake enters the details into a free paycheck creator:

-

Work period: March 1–3

-

Total earned: $1,500

-

Client: Greenlight Contractors

-

Deductions: $150 (equipment rental)

-

Net pay: $1,350

Jake now has a professional-looking pay stub he can store in his files, which proves how much he earned and from whom. If he needs to apply for a car loan or file quarterly taxes, he’s ready.

Key Benefits for Electricians and Plumbers

✅ No Accounting Knowledge Needed

You don’t need to be a financial expert. The tools are designed for simplicity. Enter your details, and the calculations happen automatically.

✅ Totally Free

The best paycheck generators free of charge don’t require a subscription or payment. That means no extra cost added to your already-expensive tools, supplies, or gas bills.

✅ Quick and Mobile-Friendly

You’re not always at a desk. Many paycheck generators are mobile-friendly, so you can create a stub right from your truck or the job site using your phone.

✅ Helps Track Deductions

If you deduct expenses for tax purposes—like fuel, tools, or protective gear—having organized pay stubs helps separate your business income from business expenses.

What to Look For in a Free Paycheck Creator

Not all paycheck generators are the same. When choosing one, make sure it offers:

-

Customization options (add your own business logo or job details)

-

Accurate tax calculation (federal, state, and local)

-

Downloadable PDF files

-

No watermarks or hidden fees

-

Easy interface that doesn’t require training

Tools like eFormscreator offer these features and are built with freelancers and independent contractors in mind.

Common Questions Freelance Tradespeople Ask

Is it legal to use a paycheck creator for myself?

Yes. As long as you’re accurately reporting your income and not trying to deceive anyone, it’s perfectly legal to create your own pay stubs as proof of payment.

Do I need to pay taxes on the income I show?

Yes. If you’re a freelancer, you’re responsible for tracking your income and paying self-employment taxes. A paycheck creator just helps keep your records clean—it doesn’t pay your taxes for you.

What if I don’t work hourly?

No problem. A free paycheck creator can also be used for flat-fee jobs. Just enter the total payment instead of hours worked, and it’ll still generate a correct pay stub.

When You Should Use It

You can use a paycheck generator free of charge:

-

After each job to generate a stub

-

Weekly or monthly to track income

-

Before filing taxes

-

When applying for credit cards, loans, or housing

-

When organizing your freelance business records

Final Thoughts

Freelance electricians and plumbers have enough to worry about—tools, scheduling, travel, supplies, and the job itself. Managing your finances shouldn’t be another stress on your plate. A free paycheck creator offers a quick, simple, and cost-effective way to stay on top of your earnings and run your business more professionally.

From proving your income to preparing for tax time, this tool puts the power in your hands. Whether you work full–time in the trades or pick up occasional