When applying for a loan, renting an apartment, or making a big purchase, you may be asked to provide proof of income. Lenders, landlords, and financial institutions want to verify that you have a steady income before approving your request. But can a check stub serve as proof of income?

The short answer is yes—a check stub can be used as proof of income in many situations. However, there are cases where additional documents may be required.

In this guide, we’ll explain everything you need to know about using a check stub as proof of income, when it’s accepted, and what other documents you might need.

What Is a Check Stub?

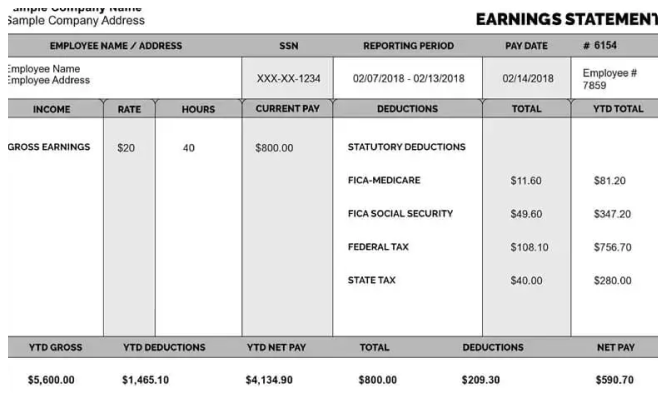

A check stub, also known as a pay stub or paycheck stub, is a document that details an employee’s earnings, deductions, and net pay for a specific pay period. If you receive a paper paycheck, your check stub is usually attached to it. If you’re paid through direct deposit, you still receive an electronic pay stub showing your payment details.

What Information Is on a Check Stub?

A check stub typically includes:

✔️ Employee name and employer information

✔️ Pay period and payment date

✔️ Gross pay (total earnings before deductions)

✔️ Taxes withheld (federal, state, and local taxes, Social Security, Medicare, etc.)

✔️ Other deductions (health insurance, 401(k), wage garnishments, etc.)

✔️ Net pay (take-home pay after deductions)

✔️ Year-to-date (YTD) totals for earnings and deductions

Because it provides a detailed breakdown of your income, a check stub is often used as proof of income.

When Can You Use a Check Stub as Proof of Income?

A check stub is commonly accepted as proof of income in the following situations:

1. Renting an Apartment or House 🏡

Landlords and property managers want to ensure that tenants can afford rent. They often ask for the last 2-3 check stubs to verify monthly income.

✔️ Example: If you earn $4,000 per month and rent is $1,200, your landlord may require recent check stubs showing your monthly pay to confirm affordability.

2. Applying for a Loan or Mortgage 🏦

Banks and lenders require proof of income when issuing personal loans, auto loans, or mortgages. A check stub can be used to show how much you earn and how consistently you get paid.

✔️ Example: If you’re applying for a $20,000 car loan, the lender may ask for your last few check stubs to confirm you have a stable income.

3. Applying for a Credit Card 💳

Credit card companies may ask for proof of income to determine your credit limit. If you don’t have tax returns or bank statements handy, a check stub can be a quick way to prove your earnings.

✔️ Example: If you apply for a high-limit credit card, the company might ask for a recent check stub to verify that you can afford the credit line.

4. Government Assistance Programs 🏛️

If you’re applying for government aid, such as food stamps (SNAP), Medicaid, or housing assistance, agencies require proof of income. Check stubs are a common document used to verify financial eligibility.

✔️ Example: If you’re applying for Medicaid, you may need to submit your last 3 check stubs to prove that your income falls within the eligibility requirements.

5. Child Support or Alimony Cases 👨👩👧👦

If you’re involved in a child support or alimony case, the court may require proof of income to determine payment amounts. Check stubs are one of the easiest ways to show how much you earn.

✔️ Example: If you’re asked to pay child support, the court may request your check stubs to calculate a fair payment based on your income.

When a Check Stub May Not Be Enough

While a check stub is often accepted as proof of income, there are some situations where additional documents may be required.

1. Self-Employed Individuals & Freelancers

If you are self-employed or work as a freelancer, you may not receive traditional check stubs. In this case, you might need to provide:

✔️ Tax returns (Form 1040 or Schedule C)

✔️ Bank statements

✔️ Invoices or payment records

✔️ Example: If you’re a freelance photographer applying for a mortgage, the lender might require tax returns instead of a check stub, since freelancers’ incomes can fluctuate.

2. Irregular or Cash-Based Income

If you are paid in cash or have irregular income, a check stub may not be enough. You might need:

✔️ Bank deposit records

✔️ Letter from an employer

✔️ Tax documents (1099, W-2, etc.)

✔️ Example: If you work as a bartender and receive mostly cash tips, your check stub may not reflect your full income, so additional proof might be required.

3. Applying for Large Loans or Mortgages

For big financial commitments (like a mortgage), lenders may require more than just check stubs. They often ask for:

✔️ Tax returns (last 2 years)

✔️ W-2 forms (for traditional employees)

✔️ Bank statements (to verify deposits match earnings)

✔️ Example: If you’re applying for a $300,000 mortgage, the bank may ask for W-2s and tax returns, even if you provide recent check stubs.

How to Get a Check Stub If You Don’t Have One

If you don’t receive traditional paycheck stubs, here are some ways to create one:

1. Ask Your Employer

Most companies provide digital check stubs through payroll systems like ADP, Paychex, or QuickBooks. Ask your HR or payroll department for a copy.

2. Use a Payroll Check Generator

If you’re self-employed, a payroll check generator can help you create check stubs to track your income. These tools allow you to:

✔️ Enter your earnings and deductions

✔️ Generate a professional pay stub

✔️ Print or download the document for proof of income

🔹 Example: A freelance graphic designer who pays themselves monthly can use a pay stub generator to create income records for lenders or landlords.

3. Use Bank Statements as a Backup

If you don’t have check stubs, bank statements showing direct deposits from your employer can serve as proof of income.

Final Thoughts

A check stub is a valuable document that serves as proof of income in many situations, including:

✔️ Renting an apartment

✔️ Applying for a loan or credit card

✔️ Qualifying for government benefits

✔️ Court-ordered child support or alimony

However, in some cases—such as for self-employed workers or large financial transactions—additional documents like tax returns, bank statements, or W-2s may be required.

If you don’t have traditional paycheck stubs, you can use a payroll check generator to create one or provide alternative proof of income.